Choosing the right personal credit card is easier than ever with us. There are many different credit cards serving different purposes. First Bank Hampton offers you more choices, great rates and exclusive benefits! Find the perfect card to meet your needs.

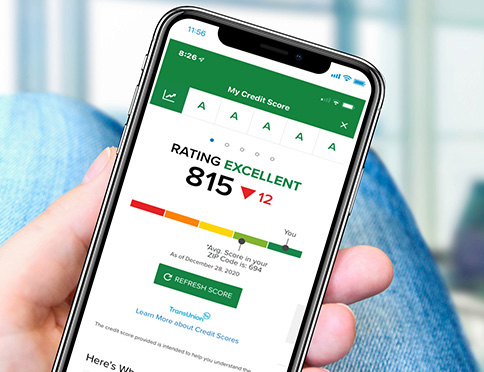

Introducing MyCard Mobile

Get quick and secure access to your credit card account wherever you are. Introducing MyCard Mobile App for your First Bank Hampton credit card! ³ Download the app today to manage your card anywhere, anytime. MyCard Mobile allows you to do the following:

- Make a payment, check your balance and transaction history

- See enriched date combining location, merchant and map

- Lock and report lost or stolen credit cards

- View spend insights with graphs

- Receive transactions and account alerts

Visit the app store on your Apple or Android device to download the app today!

If you have a lost or stolen Credit Card

It’s important to act quickly. Contact the Credit Card Company, TCM Bank or First Bank Hampton so a freeze may be placed on your card and reduce the risk of fraud. Use these phone numbers:

- 24/7 TCM Bank Customer Service: 800.883.0131

- 24/7 TCM Bank Customer Service outside of the U.S: 813.868.2891

- During regular business hours - First Bank Hampton: 641.456.4793

For more information about Identity Theft and fraud, stay up to date.

Cash Rewards Platinum ¹

Our credit cards offer No Annual Fee and a special introductory Annual Percentage Rate (APR) on purchases and balances transfers along with:

- Fraud Monitoring and Zero Fraud Liability

- Chip Card Security

- 24/7 Customer Service located in the U.S.

- Balance transfers and cash advances subject to 3% fee or $5 whichever is greater.

- Rates range from 14.74% - 24.74%

Platinum Edition ¹

Our credit cards offer No Annual Fee and a special introductory Annual Percentage Rate (APR) on purchases and balances transfers along with:

- Fraud Monitoring and Zero Fraud Liability

- Chip Card Security

- 24/7 Customer Service located in the U.S.

- Balance transfers and cash advances subject to 3% fee or $5 whichever is greater.

- Rates range from 10.74 – 20.74%

Signature Travel ¹

Our credit cards offer No Annual Fee and a special introductory Annual Percentage Rate (APR) on purchases and balances transfers along with:

- Fraud Monitoring and Zero Fraud Liability

- Chip Card Security

- 24/7 Customer Service located in the U.S.

- Balance transfers and cash advances subject to 3% fee or $5 whichever is greater.

- Rates range from 14.74% - 24.74%

Rewards Platinum ¹

Our credit cards offer No Annual Fee and a special introductory Annual Percentage Rate (APR) on purchases and balances transfers along with:

- Fraud Monitoring and Zero Fraud Liability

- Chip Card Security

- 24/7 Customer Service located in the U.S.

- Balance transfers and cash advances subject to 3% fee or $5 whichever is greater.

- Rates range from 11.74% - 21.74% APR ²

¹ Services are provided by TCM Bank, N.A. and licensed from Visa, U.S.A., Inc.

² Disclosures: APR, loan term, monthly payment, and savings shown are estimated and are based on your credit profile. All loans are subject to credit approval. Cash advance rate may vary with the market based on Prime Rate.

² Disclosures: APR, loan term, monthly payment, and savings shown are estimated and are based on your credit profile. All loans are subject to credit approval. Cash advance rate may vary with the market based on Prime Rate.

³ This card is issued by TCM Bank, N.A. Subject to credit approval